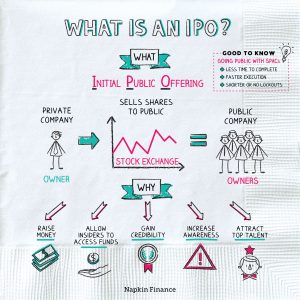

Private Equity/IPO

Core Values When Investing in Pre-IPO

Do Your Research

- Mission Alignment: Evaluate whether the startup’s mission aligns with your personal or investment objectives. A clear and compelling mission statement indicates a strong sense of purpose and direction, which can contribute to long-term success.

- Ethical Standards: Examine the startup’s commitment to ethical business practices. Companies that prioritize integrity, transparency, and accountability are more likely to build trust with stakeholders and navigate challenges effectively.

Compare and Contrast

- Innovation and Creativity: Assess the startup’s willingness to embrace innovation and creativity. Core values that emphasize innovation foster a culture of continuous improvement and adaptability, essential for staying competitive in dynamic markets.

- Team Dynamics: Consider the importance placed on teamwork, collaboration, and diversity within the startup’s core values. A diverse and inclusive workforce can bring fresh perspectives and drive innovation, contributing to the company’s growth potential.

Focus on Benefits

- Customer Focus: Evaluate the startup’s dedication to understanding and meeting customer needs. Core values centered on customer satisfaction and empathy can lead to the development of products or services that resonate with target markets, enhancing the company’s market position and revenue potential.

Focus on Foundation

- Long-Term Sustainability: Look for core values that prioritize long-term sustainability and responsible stewardship of resources. Startups committed to environmental and social responsibility are better positioned to address emerging challenges and build resilience over time.

Understanding how to evaluate pre-IPO companies.

Private equity investors conduct thorough research and analysis before investing in startups, especially in the early stages where risks are high but potential returns can be significant. Here’s a general overview of their approach:

- Deal Sourcing: Private equity investors use various channels to identify potential investment opportunities. This could include networking within industry circles, attending startup events and conferences, leveraging their own contacts, or working with venture capital firms.

- Due Diligence: Once a potential investment opportunity is identified, private equity investors conduct extensive due diligence. This involves evaluating the startup’s business model, market opportunity, competitive landscape, technology, intellectual property, team, financials, and growth potential. They may also assess regulatory risks and potential challenges.

- Valuation: Private equity investors determine the value of the startup based on its current and projected financial performance, market comparables, growth prospects, and risk factors. Valuation methods such as discounted cash flow (DCF), comparable company analysis, and precedent transactions are commonly used.

- Deal Structuring: After valuation, private equity investors negotiate the terms of the investment, including the amount of equity they will receive in exchange for their investment, governance rights, liquidation preferences, and any protective provisions.

- Value Addition: Beyond providing capital, private equity investors often offer strategic guidance, operational expertise, and industry connections to help the startup grow and succeed. They may assist with hiring key executives, refining the business strategy, expanding into new markets, or optimizing operational processes.

- Exit Strategy: Private equity investors typically have a clear exit strategy in mind when they invest in a startup. This could include selling their stake through a strategic acquisition, initial public offering (IPO), or secondary sale to another investor. The timing of the exit depends on various factors such as market conditions, the startup’s growth trajectory, and investor objectives.

- Risk Management: Private equity investors are acutely aware of the risks associated with early-stage investing. They diversify their portfolios across multiple investments to mitigate the risk of any single investment failing. They also conduct ongoing monitoring and evaluation of their portfolio companies to identify and address potential issues early on.

Achieving a 700 percent return on investment requires successful execution of the above steps, coupled with the ability to identify high-potential startups and actively contribute to their growth and success. It’s important to note that not all investments will yield such high returns, and private equity investing carries inherent risks. However, by conducting thorough research, making informed investment decisions, and actively supporting portfolio companies, private equity investors aim to generate attractive returns for their investors.

% Investing in Seed Round

% Investing in Series A Round

% Investing in Series B

Great Pre-IPO Companies

Marketplace leveraging scale and automation to connect light industrial workers with flexible shifts. 4.5X YoY revenue growth. This company has proven to go IPO soon with its expansive growth and leveraging AI effectively.

Sarga Solition Inc has developed a prototpe self driving, autonomous, modern boat that picks up seaweed/sargassum, and waste from the ocean driven by AI and completely electric.

Cognition is an applied artificial intelligence lab that focuses on reasoning and code since human cognition is one of the most important factors for humans on earth, this company has a track record to hit IPO every soon.

Fireworks partners with the world’s leading generative AI researchers to serve the best models, at the fastest speeds

Define the future of knowledge work by building intelligent agents that transform how knowledge workers collaborate with AI

Arena is building multi-modal foundation models for critical industries, empowering enterprises to make critical, high frequency decisions fully autonomous

The Deal Maker Portal is a premier platform tailored for investors, business leaders, and financial professionals to access, manage, and capitalize on private equity opportunities. Whether you’re sourcing deals, monitoring investments, or networking with like-minded individuals, this portal is your central hub for navigating the private equity landscape.

Features of the Private Equity Portal

1. Deal Sourcing & Evaluation

-

Curated Opportunities: Access a diverse range of vetted private equity deals, including buyouts, growth capital, and distressed investments.

-

Advanced Search Filters: Find opportunities tailored to your investment criteria, industry focus, and geographical preferences.

-

Due Diligence Resources: Leverage detailed financial analyses, market reports, and strategic insights to make informed decisions.

2. Portfolio Management

-

Track Investments: Monitor the performance of your portfolio with real-time updates and analytics.

-

Data Visualization Tools: Use interactive dashboards to view key metrics, trends, and ROI at a glance.

-

Reporting Automation: Generate customized reports for internal review or stakeholder presentations.

3. Networking & Collaboration

-

Exclusive Community: Engage with a network of private equity professionals, fund managers, and advisors.

-

Virtual Events: Participate in webinars, workshops, and industry roundtables to expand your knowledge and connections.

-

Secure Messaging: Collaborate with peers and partners directly within the portal.

4. Learning & Resources

-

Knowledge Center: Access a library of articles, case studies, and white papers focused on private equity strategies and market trends.

-

Toolkits: Utilize financial models, valuation templates, and deal structuring guides to streamline your workflow.

-

Mentorship Opportunities: Connect with seasoned professionals for guidance and insights into complex transactions.

5. Custom Alerts & Updates

-

Stay Informed: Receive personalized notifications about new deals, market developments, and performance updates.

-

Investor Updates: Keep track of fund activity, distributions, and capital calls.

How to Access the Private Equity Portal

-

Register or Log In:

Gain access by creating a secure account or logging in with your existing credentials. -

Set Your Preferences:

Personalize your dashboard to align with your investment goals and interests. -

Explore & Engage:

Navigate through curated opportunities, leverage resources, and connect with industry professionals to elevate your private equity experience.