Invest with a Self-Directed IRA, Like Peter Thiel

Peter Thiel made headlines with his unique approach to investing through his self-directed IRA, particularly by utilizing it to invest in early-stage startups like Facebook. Here’s a general outline of how you might follow a similar path, but please be aware that this isn’t financial advice and comes with significant risks:

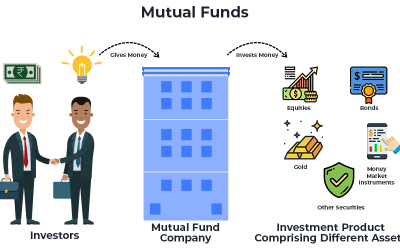

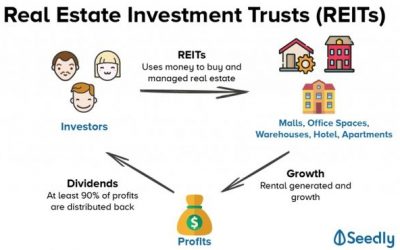

Establish a Self-Directed IRA (SDIRA): Start by setting up a self-directed IRA with a qualified custodian. Unlike traditional IRAs, SDIRAs allow you to invest in a broader range of assets beyond stocks, bonds, and mutual funds. This can include real estate, private equity, precious metals, and even startups.

Contribute Funds: Once your SDIRA is set up, you can contribute funds to it just like you would with a regular IRA. There are annual contribution limits imposed by the IRS, so make sure you adhere to those.

Due Diligence: Before investing, conduct thorough due diligence on any potential investment opportunities. This is especially crucial for investments in startups, as they carry high risks. Consider factors like the business model, market potential, competition, management team, and exit strategy.

Investment Selection: Identify startups or other alternative investments that align with your risk tolerance, investment goals, and expertise. You may need to network within entrepreneurial communities or use platforms that connect investors with startups seeking funding.

Investment Process: Once you’ve identified a promising opportunity, work with your SDIRA custodian to execute the investment. The custodian will handle the necessary paperwork and ensure compliance with IRS regulations regarding IRA investments.

Manage and Monitor: After making investments, stay actively involved in monitoring their progress. For startups, this might involve attending shareholder meetings, reviewing financial reports, and staying informed about industry trends. Remember that startup investments are typically illiquid and may require several years before seeing any returns, if at all.

Tax Considerations: Be aware of the tax implications associated with investments made through an IRA. For example, any gains realized within the IRA are typically tax-deferred or tax-free, depending on whether it’s a traditional or Roth IRA. However, there may be unrelated business income tax (UBIT) consequences for certain types of investments, such as leveraged real estate or actively managed businesses.

Seek Professional Advice: Given the complexities and risks involved in alternative investments, including startups, it’s wise to consult with financial advisors, tax professionals, and legal experts who specialize in self-directed retirement accounts.

Remember that while Peter Thiel’s success with his self-directed IRA investments is well-documented, it’s an unconventional and high-risk strategy that may not be suitable for everyone. Be sure to carefully evaluate your own financial situation, risk tolerance, and investment objectives before pursuing similar strategies.

Building A Strong Credit Score

Building a strong credit score is essential for accessing favorable financing options when building a real estate portfolio. Here are some steps you can take to improve your credit score:

Check Your Credit Report: Obtain a copy of your credit report from each of the major credit bureaus (Experian, TransUnion, and Equifax) and review it for any errors or inaccuracies. Dispute any discrepancies you find.

Pay Bills on Time: Payment history is one of the most significant factors in your credit score. Make sure to pay all your bills, including credit cards, loans, and utilities, on time.

Reduce Credit Card Balances: Aim to keep your credit card balances low relative to your credit limits. High credit utilization can negatively impact your credit score. Try to pay down existing balances as much as possible.

Don’t Close Unused Accounts: Closing old credit card accounts can reduce your available credit and shorten your credit history, both of which can lower your credit score. Instead, consider keeping these accounts open, even if you don’t use them regularly.

Diversify Your Credit Mix: Having a mix of different types of credit, such as credit cards, auto loans, and mortgages, can positively impact your credit score. However, only take on new credit accounts if you need them and can manage them responsibly.

Limit New Credit Inquiries: Each time you apply for new credit, it triggers a hard inquiry on your credit report, which can temporarily lower your score. Minimize the number of new credit inquiries, especially within a short period.

Become an Authorized User: If you have a family member or friend with a long, positive credit history, consider asking them to add you as an authorized user on one of their credit card accounts. This can potentially boost your credit score, but be sure to choose someone who manages their credit responsibly.

Be Patient: Building good credit takes time, so be patient and consistent with your efforts. Focus on responsible credit management habits, and your score will gradually improve over time.

By taking these steps, you can strengthen your credit score, which will help you qualify for better financing options as you build your real estate portfolio.

Exiting Your Startup?

Starting up a company typically involves several key steps:

Idea Generation: Entrepreneurs come up with a business idea or identify a problem they want to solve.

Market Research: They conduct thorough research to understand the market demand, competition, and potential customers for their product or service.

Business Planning: Entrepreneurs create a business plan outlining their goals, target market, revenue model, and operational strategy.

Funding: They may seek funding from various sources such as personal savings, friends and family, angel investors, venture capitalists, or through crowdfunding platforms.

Legal Setup: Entrepreneurs register their company, obtain necessary licenses and permits, and set up legal structures such as partnerships, LLCs, or corporations.

Product Development: They develop their product or service, often iterating based on feedback from early customers or users.

Marketing and Sales: Entrepreneurs market their product or service to attract customers and generate sales.

Scaling: Once the business gains traction, they focus on scaling operations to meet growing demand.

Exiting a company can happen through various means:

Acquisition: A larger company buys the startup, often to integrate its technology, talent, or customer base into their own operations.

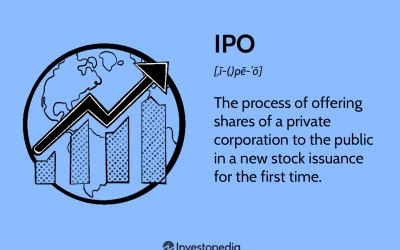

IPO (Initial Public Offering): The startup goes public by offering shares to the public through a stock exchange, allowing early investors and founders to sell their shares and exit.

Merger: The startup merges with another company to form a larger entity.

Management Buyout: The existing management team buys out the ownership stake from investors or founders.

Shutdown: In some cases, startups may fail to achieve success and are shut down, resulting in the liquidation of assets and closure of operations.

Each path to exit has its own considerations in terms of financial outcomes, impact on employees, and future opportunities for founders and investors.

The Future of AI And Investments

The future of AI and investments is promising, as AI technologies have the potential to revolutionize how investment decisions are made, portfolios are managed, and risks are mitigated. Here are some key ways AI is expected to impact the investment landscape:

Data Analysis and Insights: AI algorithms can analyze vast amounts of data from diverse sources, including market trends, financial statements, news articles, social media, and alternative data sources. By processing and interpreting this data in real-time, AI can identify patterns, correlations, and anomalies that human analysts might overlook, providing valuable insights for investment decision-making.

Quantitative Trading and Algorithmic Investing: AI-powered algorithms can execute trades automatically based on predefined rules and strategies, such as trend-following, statistical arbitrage, or machine learning models. These quantitative trading strategies can exploit market inefficiencies, minimize emotional biases, and optimize trading execution, leading to potentially higher returns and lower transaction costs.

Portfolio Optimization: AI can optimize investment portfolios by analyzing asset correlations, risk factors, and return expectations to achieve desired investment objectives, such as maximizing returns, minimizing risk, or achieving a target asset allocation. AI-driven portfolio management platforms can rebalance portfolios dynamically in response to changing market conditions and investor preferences, enhancing diversification and performance.

Risk Management and Fraud Detection: AI technologies can assess investment risks, identify potential threats, and detect fraudulent activities in financial markets. By analyzing historical data, market trends, and macroeconomic indicators, AI models can quantify various types of risk, such as market risk, credit risk, liquidity risk, and operational risk, helping investors make informed decisions and mitigate potential losses.

Alternative Investments and Asset Classes: AI can facilitate the analysis and valuation of alternative investments, such as private equity, venture capital, real estate, and cryptocurrencies. AI-driven models can evaluate investment opportunities, estimate intrinsic values, and assess risk-adjusted returns in non-traditional asset classes, expanding investment options and diversification opportunities for investors.

Robo-Advisors and Financial Planning: AI-powered robo-advisors can provide personalized investment advice, asset allocation recommendations, and financial planning services to individual investors at a fraction of the cost of traditional financial advisors. By leveraging machine learning algorithms and natural language processing techniques, robo-advisors can assess investors’ risk tolerance, investment goals, and financial preferences to offer customized investment solutions tailored to their needs.

Overall, AI is expected to play a transformative role in the investment industry by augmenting human decision-making, improving investment efficiency, and democratizing access to sophisticated investment strategies and tools. However, it’s essential to address potential challenges related to data privacy, algorithmic bias, regulatory compliance, and ethical considerations to ensure that AI technologies are deployed responsibly and ethically in the investment sector.

AI and Futuristic Real Estate Predictions

Artificial intelligence (AI) is poised to have a significant impact on the future of real estate in various ways:

Property Search and Recommendation: AI algorithms can analyze vast amounts of data to provide personalized property recommendations based on a buyer’s preferences, budget, location, and other criteria. This can streamline the property search process and improve the accuracy of matching buyers with suitable listings.

Predictive Analytics: AI can be used to forecast market trends, property values, and investment opportunities by analyzing historical data, market indicators, and economic factors. This predictive analytics capability can help investors and developers make informed decisions about buying, selling, or investing in real estate.

Property Valuation: AI-powered valuation models can provide more accurate and timely property valuations by considering a wide range of factors, including comparable sales, market trends, property condition, and location data. This can benefit sellers, buyers, lenders, and appraisers in determining fair market values and assessing property risk.

Smart Buildings and Property Management: AI-driven smart building technologies can optimize energy efficiency, automate maintenance tasks, and enhance security in commercial and residential properties. These systems can monitor and control various building systems in real-time, leading to cost savings, improved tenant satisfaction, and better asset performance.

Customer Service and Communication: AI-powered chatbots and virtual assistants can handle inquiries, schedule appointments, and provide information to clients and tenants. These AI agents can offer 24/7 support, answer frequently asked questions, and assist users in navigating the real estate process more efficiently.

Risk Assessment and Fraud Detection: AI algorithms can analyze financial data, credit scores, and transaction histories to assess borrower risk and detect fraudulent activities in mortgage lending and real estate transactions. This can help lenders, insurers, and regulators mitigate risks and prevent financial losses.

Construction and Development: AI technologies such as generative design, robotics, and 3D printing can streamline the construction process, reduce costs, and improve the quality of buildings. AI can optimize building designs, automate repetitive tasks, and enhance safety on construction sites, leading to faster project delivery and increased sustainability.

Overall, AI has the potential to revolutionize the real estate industry by enabling smarter decision-making, improving operational efficiency, and enhancing the customer experience across various segments of the market. However, it’s essential to address potential challenges related to data privacy, algorithm bias, and workforce displacement to ensure that AI technologies are deployed responsibly and ethically in the real estate sector.

Real Estate Market in the Next 10 Years?

Predicting the real estate market over the next decade involves considering various factors like economic trends, population growth, housing demand, interest rates, government policies, and technological advancements. While I can’t offer a crystal-clear prediction, here are some trends that might shape the real estate market in the coming years:

Urbanization vs. Suburbanization: The ongoing trend of urbanization might continue, especially in developing countries. However, recent shifts due to the COVID-19 pandemic have also highlighted the appeal of suburban and rural areas. The balance between urban and suburban living could change, affecting property values in different areas.

Technology Integration: Advancements like virtual reality tours, smart home features, and online real estate platforms are likely to become more prevalent, influencing how properties are marketed, sold, and managed.

Sustainability and Green Building: With increasing environmental awareness, there might be a growing demand for eco-friendly and energy-efficient properties. Sustainable building practices could become more mainstream, impacting property development and investment decisions.

Demographic Changes: As millennials and Gen Z become major players in the housing market, their preferences and priorities—such as sustainability, connectivity, and flexible living arrangements—could drive changes in housing designs and locations.

Interest Rates: Fluctuations in interest rates can significantly affect the real estate market. If interest rates remain low, it might encourage borrowing and stimulate housing demand. However, a sudden increase could lead to decreased affordability and slower market activity.

Government Policies: Changes in regulations, tax policies, and government initiatives can influence property prices and market dynamics. For example, incentives for affordable housing or zoning regulations might impact development patterns.

Global Economic Conditions: Economic factors such as GDP growth, employment rates, inflation, and geopolitical stability can affect real estate markets worldwide. Economic downturns can lead to decreased demand and lower property prices, while periods of prosperity can drive investment and growth.

Housing Affordability: Affordability issues in many markets could continue to be a concern, especially in major cities. This might lead to increased demand for rental properties, co-living spaces, or innovative housing solutions.

Overall, while it’s challenging to predict the real estate market with certainty, staying informed about these trends and understanding local market conditions will be crucial for investors, developers, and homebuyers in navigating the real estate landscape over the next decade.

Several apps cater to real estate investors by providing tools for managing tenants, rental properties, and payment systems. Here are some popular ones:

Cozy: Cozy offers a comprehensive platform for landlords to manage rental properties, screen tenants, collect rent payments, and handle maintenance requests. It also provides features for lease management and rental accounting.

Buildium: Buildium is a property management software designed for real estate investors, property managers, and homeowner associations. It offers features for tenant screening, lease management, rent collection, maintenance tracking, and financial reporting.

Rentec Direct: Rentec Direct is a property management software solution that helps landlords and property managers streamline rental property operations. It offers tools for tenant screening, online rent collection, expense tracking, and property maintenance.

RentRedi: RentRedi is a mobile-friendly property management app that simplifies landlord tasks such as tenant screening, lease signing, rent collection, and maintenance coordination. It also provides features for communication with tenants and document storage.

Landlord Studio: Landlord Studio is a rental property management app that offers features for tracking rental income and expenses, managing lease agreements, and generating financial reports. It also includes tools for tenant communication and rent reminders.

TenantCloud: TenantCloud is a cloud-based property management platform that helps landlords and property managers manage rental properties, screen tenants, collect rent payments, and handle maintenance requests. It also offers features for online lease signing and communication with tenants.

Avail: Avail is a rental property management platform that simplifies the process of finding tenants, screening applicants, and managing rental properties. It offers features for online rent collection, lease management, maintenance tracking, and financial reporting.

Rentigo: Rentigo is a property management app that offers tools for tenant screening, rent collection, maintenance requests, and communication with tenants. It also provides features for tracking rental income and expenses and generating financial reports.

Hemlane: Hemlane is a property management platform that helps landlords and property managers automate rental property tasks such as tenant screening, lease signing, rent collection, and maintenance coordination. It also offers features for communication with tenants and financial reporting.

Stessa: Stessa is a rental property management platform that offers features for tracking rental income and expenses, managing leases, and generating financial reports. It also provides tools for analyzing property performance and optimizing investment strategies.

These apps offer a range of features and pricing plans, so real estate investors can choose the one that best fits their needs and budget.

Is AI Replacing Real Estate Agents?

AI has indeed started to make inroads into the real estate industry, but it’s more about augmenting the role of real estate agents rather than replacing them entirely. Here are some ways AI is impacting the industry:

Data Analysis: AI can analyze vast amounts of data to provide insights into market trends, property valuations, and investment opportunities, empowering real estate agents with valuable information to better serve their clients.

Personalized Recommendations: AI-powered algorithms can generate personalized property recommendations based on factors such as location preferences, budget constraints, and lifestyle choices, enhancing the customer experience and streamlining the property search process.

Automated Communication: AI chatbots and virtual assistants can handle routine inquiries, schedule appointments, and provide instant responses to client questions, freeing up real estate agents to focus on more complex tasks and client interactions.

Predictive Analytics: AI algorithms can forecast market trends, identify emerging opportunities, and anticipate future demand, enabling real estate agents to make more informed decisions and strategic investments.

Virtual Tours and 3D Visualization: AI technologies, such as virtual reality (VR) and augmented reality (AR), enable immersive virtual property tours and 3D visualization, allowing buyers to explore properties remotely and visualize potential renovations or modifications.

Automated Transaction Management: AI-powered platforms can automate various aspects of the transaction process, including paperwork, contract management, and legal documentation, reducing administrative burdens and streamlining the closing process.

While AI has the potential to automate certain tasks and improve efficiency in the real estate industry, human expertise, empathy, and interpersonal skills remain essential for complex negotiations, relationship building, and providing personalized advice and support to clients. Therefore, rather than replacing real estate agents, AI is likely to complement their roles, enabling them to deliver greater value to their clients and adapt to evolving market dynamics.

2024 Top Real Estate Concerns

In 2024, the top real estate concerns may include:

Market Volatility: Economic uncertainty, geopolitical tensions, and other global factors can contribute to market volatility, impacting property values and investment decisions.

Housing Affordability: The ongoing challenge of housing affordability persists, particularly in urban centers and high-demand areas, where limited supply meets high demand, driving up prices and making homeownership less attainable for many.

Sustainability and Resilience: With increasing awareness of climate change and environmental sustainability, there’s a growing emphasis on green building practices, energy efficiency, and resilience measures in real estate development and management.

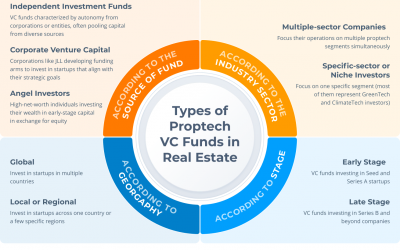

Technology Integration: The integration of technology in real estate, including PropTech solutions, smart buildings, and digital platforms for property transactions, management, and marketing, is reshaping the industry and posing challenges and opportunities for traditional players.

Regulatory Changes: Shifts in regulations and government policies, such as tax reforms, zoning laws, and land use regulations, can have significant impacts on real estate markets, influencing investment strategies and development trends.

Remote Work Trends: The rise of remote work and hybrid work models following the COVID-19 pandemic has altered the demand for commercial real estate, with implications for office space utilization, location preferences, and investment priorities.

Supply Chain Disruptions: Disruptions in global supply chains, labor shortages, and material cost inflation can affect construction timelines, project costs, and property development feasibility.

Demographic Shifts: Changing demographics, including population growth, aging populations, and migration patterns, influence housing demand, preferences, and market dynamics in different regions.

Health and Safety Concerns: The ongoing focus on health and safety, including concerns related to pandemics and public health emergencies, impacts design standards, building codes, and tenant expectations in real estate markets.

Geopolitical Risks: Geopolitical tensions, trade disputes, and geopolitical risks can create uncertainties in real estate markets, affecting investor confidence, capital flows, and market stability.

These concerns may vary in significance depending on the region, market segment, and specific circumstances, but they collectively shape the landscape of the real estate industry in 2024.

Crypto Funds? What are They?

A crypto fund is an investment vehicle that pools capital from investors and allocates it to various cryptocurrency assets or related instruments. These funds provide investors with exposure to the burgeoning digital asset market, allowing them to gain diversified exposure to cryptocurrencies without the need to directly buy, hold, and manage individual digital assets themselves. Crypto funds can vary widely in their investment strategies, risk profiles, and regulatory structures, catering to different investor preferences and risk appetites.

Here are some key aspects of crypto funds:

Investment Strategies:

Passive Funds: Some crypto funds passively track the performance of a specific cryptocurrency index, such as the Bloomberg Galaxy Crypto Index or the Bitwise 10 Crypto Index. These funds aim to replicate the returns of the underlying index by holding a diversified portfolio of cryptocurrencies in proportion to their weights in the index.

Actively Managed Funds: Other crypto funds employ active management strategies, where fund managers actively trade and rebalance the fund’s portfolio in response to market conditions, news events, or proprietary research. Active managers may seek to generate alpha (excess returns) by taking advantage of market inefficiencies, arbitrage opportunities, or sector-specific trends within the cryptocurrency market.

Quantitative and Algorithmic Funds: Some crypto funds use quantitative models or algorithmic trading strategies to execute trades based on predefined criteria, technical indicators, or machine learning algorithms. These funds may engage in high-frequency trading, market-making, or statistical arbitrage to capitalize on short-term price movements and generate consistent returns.

Venture Capital and Private Equity Funds: Certain crypto funds focus on investing in early-stage blockchain projects, initial coin offerings (ICOs), or tokenized securities through venture capital or private equity-style investments. These funds may take equity stakes in blockchain startups, participate in token sales, or provide financing in exchange for tokens or other digital assets.

Diversification:

Crypto funds offer investors exposure to a diversified portfolio of cryptocurrencies, which may include well-established assets such as Bitcoin and Ethereum, as well as emerging altcoins, tokens, and decentralized finance (DeFi) protocols. Diversification across multiple assets can help mitigate individual asset risk and volatility, reducing the impact of adverse price movements on the fund’s overall performance.

Risk Management:

Crypto funds typically implement risk management techniques to manage portfolio risk and protect investor capital. These may include position limits, stop-loss orders, portfolio rebalancing, and hedging strategies using derivatives or options contracts. Risk management is particularly crucial in the highly volatile and speculative cryptocurrency market, where prices can experience rapid fluctuations and significant drawdowns.

Regulatory Considerations:

Regulatory considerations play a significant role in the operation and distribution of crypto funds, as the regulatory landscape for digital assets continues to evolve globally. Depending on the jurisdiction and fund structure, crypto funds may need to comply with securities laws, anti-money laundering (AML) regulations, know-your-customer (KYC) requirements, and tax regulations. Some crypto funds operate as regulated investment vehicles, while others may operate in jurisdictions with more permissive regulatory frameworks or seek regulatory exemptions or licenses.

Access and Liquidity:

Investing in a crypto fund provides investors with access to the cryptocurrency market through a regulated and professionally managed investment vehicle. This can be particularly appealing for institutional investors, family offices, and high-net-worth individuals who may have limited experience or infrastructure to custody and trade digital assets securely. Additionally, crypto funds may offer enhanced liquidity compared to direct investments in individual cryptocurrencies, as investors can buy and sell fund shares on secondary markets or through fund redemptions.

Overall, crypto funds play a crucial role in democratizing access to the cryptocurrency market, providing investors with diversified exposure to digital assets and professional management expertise to navigate the complexities and risks of investing in this emerging asset class. However, investors should conduct thorough due diligence, understand the fund’s investment strategy and risk factors, and consider their own investment objectives and risk tolerance before investing in a crypto fund.

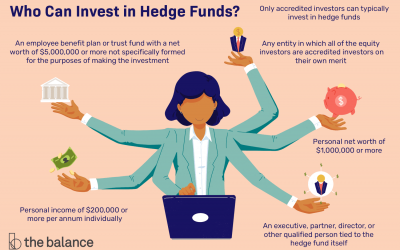

Hedgefunds, A Good Investment Strategy?

ChatGPT

A hedge fund is a type of investment fund that pools capital from accredited or institutional investors and employs a variety of investment strategies to generate returns. Unlike traditional mutual funds, hedge funds often have greater flexibility in their investment approach, allowing them to pursue both long and short positions in various asset classes, employ leverage, and use derivatives and other complex financial instruments to enhance returns or mitigate risk.

Here are some key characteristics of hedge funds:

Managerial Expertise: Hedge funds are typically managed by experienced investment professionals who employ active management strategies to seek out market inefficiencies, exploit opportunities, and generate alpha (excess returns) for investors.

Diverse Investment Strategies: Hedge funds can utilize a wide range of investment strategies, including long/short equity, global macro, event-driven, quantitative/statistical arbitrage, distressed debt, merger arbitrage, and relative value strategies, among others. This diversity allows hedge funds to adapt to changing market conditions and capitalize on a broad array of investment opportunities.

Performance-Based Compensation: Hedge fund managers often receive performance-based compensation, typically in the form of a management fee (usually around 1-2% of assets under management) and a performance fee (typically 20% of profits above a certain threshold, known as the “high-water mark”). This fee structure aligns the interests of the fund manager with those of the investors, as managers are incentivized to generate positive returns and outperform the market.

Limited Regulation: Hedge funds are subject to less regulatory oversight compared to mutual funds, allowing them greater flexibility in their investment strategies and operations. However, this lack of regulation also means that hedge funds may engage in riskier or less transparent practices, and investors should conduct thorough due diligence before investing.

Investing in a hedge fund typically requires meeting certain eligibility criteria, such as being an accredited investor or qualified purchaser, as defined by securities regulations in the investor’s jurisdiction. These criteria generally involve meeting minimum income or net worth thresholds, as well as demonstrating a level of financial sophistication and understanding of the risks associated with hedge fund investing.

Once eligible, investors can invest in a hedge fund by:

Identifying Suitable Funds: Investors can research and evaluate different hedge funds based on their investment objectives, strategies, historical performance, risk profiles, fees, and other relevant factors. This process may involve consulting with financial advisors, conducting due diligence on fund managers, and reviewing fund offering documents, such as private placement memoranda (PPMs) or prospectuses.

Completing Subscription Documents: Investors interested in investing in a hedge fund typically need to complete subscription documents provided by the fund manager or sponsor. These documents may include a subscription agreement, investor questionnaire, and other legal and regulatory disclosures.

Meeting Minimum Investment Requirements: Hedge funds often have minimum investment requirements, which can vary widely depending on the fund’s strategy, size, and investor base. Minimum investments can range from tens of thousands to millions of dollars or more, and investors should ensure they meet the fund’s minimum requirements before committing capital.

Executing Investment Terms: Once the subscription documents are completed and submitted, investors typically wire funds to the hedge fund’s designated bank account or custodian, in accordance with the terms outlined in the offering documents. Upon receipt of funds, investors become limited partners or shareholders in the hedge fund and are entitled to participate in the fund’s investment activities and share in any profits or losses generated by the fund.

It’s important for investors to conduct thorough due diligence and carefully consider the risks and potential rewards associated with hedge fund investing before making any commitments. While hedge funds can offer opportunities for diversification, alpha generation, and downside protection, they also involve risks such as illiquidity, leverage, manager risk, and market volatility. Consulting with financial advisors, conducting independent research, and seeking professional guidance can help investors make informed decisions and navigate the complexities of hedge fund investing.

Hedging, A Risk Management Strategy

Hedging is a risk management strategy employed by investors to offset potential losses in one asset or portfolio by taking an opposite position in another asset or financial instrument. The goal of hedging is to reduce the overall risk exposure of an investment portfolio and protect against adverse market movements. Here are several ways investors can hedge their investments, along with detailed explanations of each:

Options Contracts:

Put Options: Put options give the holder the right, but not the obligation, to sell an underlying asset at a predetermined price (strike price) within a specified period (expiration date). Investors can purchase put options on individual stocks, stock indices, or other financial instruments to hedge against potential downside risk. If the price of the underlying asset declines, the value of the put option increases, offsetting losses in the investor’s portfolio.

Call Options: Call options provide the holder with the right to buy an underlying asset at a predetermined price within a specified period. While primarily used for speculative purposes, call options can also be employed as part of a hedging strategy to protect against upside risk or to hedge short positions.

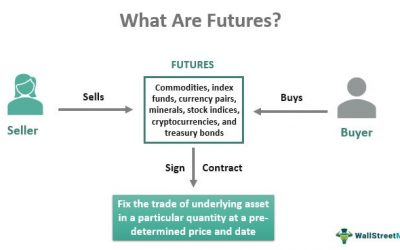

Futures Contracts:

Short Futures Position: Investors can hedge against declining prices of commodities, stock indices, or other assets by selling futures contracts. By taking a short position in futures, investors can profit from price declines in the underlying asset, thereby offsetting losses in their investment portfolio if the asset’s value decreases.

Long Futures Position: Conversely, investors can hedge against rising prices by purchasing futures contracts, effectively locking in the current price of the underlying asset and mitigating the risk of future price increases.

Forward Contracts:

Similar to futures contracts, forward contracts allow investors to lock in the future price of an asset at a predetermined date. Forward contracts are customized agreements between two parties, typically traded over-the-counter (OTC), and are commonly used to hedge against currency risk, interest rate risk, or commodity price fluctuations.

Short Selling:

Short selling involves borrowing shares of a security from a broker and selling them on the open market with the intention of buying them back at a later time to return to the lender. Investors can use short selling as a hedging strategy to profit from declining prices of specific stocks or to offset gains in other parts of their portfolio.

Inverse ETFs and Derivatives:

Inverse exchange-traded funds (ETFs) and other inverse derivatives are designed to move in the opposite direction of their underlying benchmark or index. By investing in inverse ETFs or derivatives, investors can hedge against downturns in specific sectors, markets, or asset classes without the need for complex options or futures strategies.

Diversification:

Diversification is a fundamental risk management technique that involves spreading investments across different asset classes, sectors, regions, and investment strategies. By diversifying their portfolios, investors can reduce the overall risk exposure and volatility, thereby mitigating the impact of adverse market movements on their investment returns.

Non-Correlated Assets:

Investing in non-correlated assets or uncorrelated strategies can provide additional diversification benefits and hedge against systemic risks in the financial markets. Non-correlated assets, such as gold, real estate, or alternative investments like hedge funds or private equity, may exhibit different return patterns compared to traditional stocks and bonds, making them valuable additions to a diversified investment portfolio.

Risk Management Techniques:

Beyond specific hedging instruments, investors can implement various risk management techniques to protect their investments, such as setting stop-loss orders, establishing position limits, maintaining disciplined portfolio rebalancing, and conducting thorough fundamental and technical analysis to identify potential risks and opportunities in the market.

It’s important for investors to carefully consider their investment objectives, risk tolerance, and market outlook when implementing hedging strategies. While hedging can help mitigate downside risk and preserve capital in adverse market conditions, it also involves costs, complexities, and potential trade-offs that should be evaluated in the context of the investor’s overall portfolio strategy. Additionally, hedging strategies may not always be effective or successful in fully eliminating investment risk, and investors should seek professional advice or conduct thorough research before implementing any hedging techniques.

Hotel Investors During the Pandemic

During the COVID-19 pandemic, some hotel investors were able to acquire properties at deeply discounted prices in South Florida for a “penny on the dollar” due to several factors:

Impact of the Pandemic on Hospitality Industry: The hospitality industry, including hotels, was severely affected by the COVID-19 pandemic. Travel restrictions, lockdowns, and decreased consumer confidence led to a significant drop in hotel occupancy rates and revenue. Many hotels struggled to cover operating expenses, mortgage payments, and other financial obligations, resulting in distressed sales and opportunities for investors to acquire properties at discounted prices.

Financial Distress of Hotel Owners: As the pandemic persisted and financial challenges mounted for hotel owners, some were forced to sell their properties to avoid foreclosure or bankruptcy. Distressed hotel owners may have been more willing to negotiate lower sale prices to offload their assets quickly and mitigate further financial losses. This created opportunities for savvy investors to acquire hotels at prices significantly below their pre-pandemic market value.

Lack of Liquidity and Financing Challenges: The economic uncertainty and tightened lending conditions during the pandemic made it difficult for hotel owners to secure financing or refinance existing debt. Limited access to capital constrained their ability to withstand prolonged periods of reduced revenue and prompted some owners to seek buyers for their properties at discounted prices. Cash-rich investors or those with access to alternative financing sources could capitalize on these opportunities and acquire hotels at favorable terms.

Market Timing and Investor Sentiment: Market timing played a crucial role in acquiring hotels at deeply discounted prices during the pandemic. Investors who were prepared to act quickly, had sufficient liquidity, and were willing to take calculated risks in an uncertain market environment were able to capitalize on distressed sale opportunities. Additionally, investor sentiment and confidence in the long-term recovery of the hospitality industry influenced the willingness to invest in hotel properties despite short-term challenges.

Location-Specific Factors: South Florida, known for its vibrant tourism industry and desirable real estate market, experienced unique dynamics during the pandemic. While the region faced significant disruptions to tourism and travel-related activities, the long-term appeal of South Florida as a tourist destination and investment hub remained intact. Investors recognized the resilience of the market and viewed the downturn as a temporary setback, positioning themselves to acquire hotel assets at discounted prices with confidence in future recovery and appreciation potential.

Overall, the convergence of these factors created opportunities for hotel investors to acquire properties in South Florida at prices significantly below their pre-pandemic levels, allowing them to secure assets at a fraction of their true value and potentially realize substantial returns as the hospitality industry rebounds and travel demand recovers.

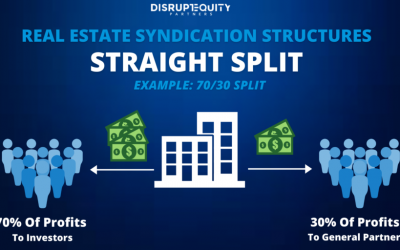

Syndication, A good Investment?

Syndication, in the context of investment, refers to the pooling of resources from multiple investors to collectively invest in a particular venture or asset. This approach offers several advantages that make it an attractive investment strategy:

Access to Larger Investments: Syndication allows individual investors to participate in larger deals that they might not be able to afford on their own. By pooling resources, investors can collectively access high-value opportunities such as commercial real estate, large-scale development projects, or substantial business acquisitions.

Diversification: Syndication provides diversification benefits by spreading investment across multiple projects or assets within a syndicate. Diversifying across various ventures helps mitigate the risk associated with any single investment. For instance, if one property in a real estate syndication performs poorly, the impact on individual investors is minimized due to their exposure to other properties within the syndicate.

Expertise and Management: Syndication often involves professional syndicators or sponsors who possess specialized knowledge and experience in the targeted investment area. These experts manage the investment process, from identifying opportunities and conducting due diligence to executing the investment strategy and overseeing ongoing operations. Investors benefit from the expertise of the syndicator, reducing their need for in-depth knowledge or active involvement in the day-to-day management of the investment.

Passive Income: Many syndicated investments, such as real estate partnerships or business ventures, generate passive income streams for investors. Income distributions from rental properties, dividends from business profits, or interest payments from debt investments provide investors with regular cash flow without requiring active participation in the operations of the underlying asset.

Scale and Efficiency: Syndication enables efficient capital deployment by aggregating funds from multiple investors to pursue larger opportunities. This scale often translates into better negotiation power, access to favorable financing terms, and lower transaction costs. Additionally, syndication structures allow investors to benefit from economies of scale in asset management and operational efficiencies.

Risk Mitigation: While all investments carry inherent risks, syndication can help mitigate certain risks through shared responsibility and collective decision-making. In real estate syndication, for example, investors may benefit from shared liability protection, as well as risk-sharing mechanisms embedded within the partnership agreements.

Tax Benefits: Syndicated investments may offer tax advantages, such as depreciation deductions, capital gains treatment, or pass-through taxation, depending on the structure of the investment vehicle and the jurisdiction’s tax laws. These tax benefits can enhance the overall returns for investors.

Networking and Opportunities: Participating in syndication provides investors with opportunities to network with other like-minded individuals and industry professionals. Through syndication networks, investors can access a broader range of investment opportunities, share insights and experiences, and build relationships that may lead to future collaborations or deals.

However, it’s essential to note that syndicated investments also come with certain considerations and potential drawbacks. These may include reduced control over decision-making, the need to perform thorough due diligence on the syndicator and investment opportunities, the possibility of conflicts of interest, and the potential for illiquidity depending on the investment structure. As with any investment, thorough research and careful consideration of one’s financial goals and risk tolerance are crucial before participating in syndication.

Investing into AI, The New Avenue!

Investing in AI can offer significant returns on investment due to the transformative potential of artificial intelligence technologies across various industries. Here’s an in-depth exploration of why investing in AI is compelling, who is investing in AI, and an analysis of Nvidia, a prominent player in the AI space:

Why Investing in AI is a Good Return on Investment:

Market Growth: The AI market is experiencing rapid growth driven by increasing demand for AI-powered solutions in sectors such as healthcare, finance, automotive, retail, and manufacturing. Market research forecasts substantial growth in AI spending, driven by advancements in machine learning, deep learning, natural language processing, computer vision, and robotics.

Efficiency and Productivity: AI technologies enable automation, optimization, and efficiency improvements across various processes, leading to cost savings, productivity gains, and competitive advantages for businesses. AI-powered solutions can streamline operations, enhance decision-making, and drive innovation, resulting in improved business performance and profitability.

Insight and Personalization: AI enables data-driven insights and personalized experiences by analyzing vast amounts of data, identifying patterns, and predicting outcomes. Businesses can leverage AI to better understand customer behavior, preferences, and needs, enabling targeted marketing, product recommendations, and customer service enhancements.

Innovation and Disruption: AI fosters innovation and disruption by unlocking new possibilities for problem-solving, creativity, and discovery. Startups and tech companies are leveraging AI to develop groundbreaking products and services, disrupt traditional industries, and create new business models, leading to market differentiation and competitive advantages.

Long-Term Trends: AI is a transformative technology with far-reaching implications for society, economy, and culture. As AI continues to advance and integrate into various aspects of daily life, investing in AI offers exposure to long-term trends and growth opportunities, positioning investors to benefit from the AI revolution.

Who is Investing into AI:

Technology Companies: Leading technology companies, including Google, Amazon, Microsoft, Apple, and Facebook, are heavily investing in AI research, development, and acquisitions to strengthen their AI capabilities and maintain competitive edge across their product portfolios.

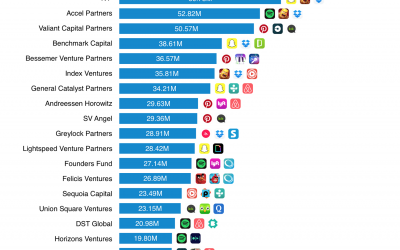

Venture Capital Firms: Venture capital firms are actively investing in AI startups and emerging technologies, providing funding, mentorship, and strategic support to fuel innovation and growth in the AI ecosystem. Venture capital investments in AI have surged in recent years, reflecting the growing interest and opportunity in the sector.

Corporate Investors: Established companies across industries are investing in AI to drive digital transformation, improve operational efficiency, and enhance customer experiences. Industries such as healthcare, finance, automotive, retail, and manufacturing are incorporating AI into their business strategies to gain a competitive advantage and adapt to changing market dynamics.

Government and Research Institutions: Governments and research institutions are investing in AI research, development, and education to advance scientific knowledge, foster innovation, and address societal challenges. Public funding initiatives, research grants, and partnerships support AI research and development efforts, driving progress in AI technologies and applications.

Nvidia’s Performance in the AI Space:

Nvidia Corporation is a leading provider of graphics processing units (GPUs), AI computing platforms, and technologies for gaming, professional visualization, data centers, and autonomous vehicles. Nvidia’s GPUs are widely used in AI applications, particularly in deep learning and accelerated computing, due to their parallel processing capabilities and efficiency in handling large-scale data and complex algorithms.

AI Computing Platforms: Nvidia offers a range of AI computing platforms, including the Nvidia DGX systems, Nvidia GPU Cloud (NGC), and Nvidia TensorRT software, designed to accelerate AI model training, inference, and deployment in data centers and edge devices.

Deep Learning: Nvidia’s GPUs are widely adopted for deep learning tasks, such as image recognition, natural language processing, and autonomous driving, due to their superior performance and efficiency. Nvidia’s CUDA parallel computing platform and cuDNN library optimize deep learning frameworks like TensorFlow, PyTorch, and MXNet for GPU acceleration.

Partnerships and Collaborations: Nvidia collaborates with leading technology companies, research institutions, and industry partners to advance AI research, develop innovative AI solutions, and drive adoption across industries. Partnerships with companies like Microsoft, IBM, and AWS expand Nvidia’s reach and ecosystem in the AI market.

Financial Performance: Nvidia has delivered strong financial performance driven by the growing demand for AI computing, gaming, and data center solutions. Revenue from Nvidia’s data center segment, which includes AI computing platforms, has experienced significant growth in recent years, contributing to the company’s overall success and market leadership in AI technologies.

Overall, Nvidia’s focus on AI computing, deep learning, and GPU-accelerated computing positions the company as a key player in the AI space, with opportunities for continued growth and innovation in the evolving AI ecosystem. As AI adoption expands across industries and applications, Nvidia is well-positioned to capitalize on the increasing demand for AI technologies and solutions, driving value for customers, partners, and shareholders alike.

Top 50 Investment Quotes for Inspiration

Inspirational quotes hold significant importance for several reasons:

Motivation and Encouragement: Inspirational quotes have the power to uplift and motivate individuals, providing encouragement during challenging times or when pursuing ambitious goals. They can serve as a source of inspiration to keep going despite obstacles or setbacks.

Perspective Shift: Inspirational quotes often offer a fresh perspective on life, relationships, and personal growth. They can challenge conventional thinking and encourage individuals to adopt a more positive and proactive mindset.

Empowerment: Inspirational quotes empower individuals to believe in themselves and their abilities. They remind us that we have the strength, resilience, and potential to overcome adversity and achieve our dreams.

Here’s a compilation of 50 investment quotes by famous investors:

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

“The four most dangerous words in investing are: ‘This time it’s different.'” – Sir John Templeton

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

“Price is what you pay. Value is what you get.” – Warren Buffett

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” – Benjamin Graham

“The best investment you can make is in yourself.” – Warren Buffett

“Risk comes from not knowing what you’re doing.” – Warren Buffett

“Be fearful when others are greedy, and greedy when others are fearful.” – Warren Buffett

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

“The investor’s chief problem—and even his worst enemy—is likely to be himself.” – Benjamin Graham

“The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” – Sir John Templeton

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.” – Peter Lynch

“The goal of a successful investor is to buy low and sell high.” – Seth Klarman

“The most important quality for an investor is temperament, not intellect.” – Warren Buffett

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” – Warren Buffett

“Know what you own, and know why you own it.” – Peter Lynch

“The investor’s worst enemy is not the stock market but his own emotions.” – Benjamin Graham

“A great company is one that will be great for a long time.” – Warren Buffett

“Successful investing is about managing risk, not avoiding it.” – Benjamin Graham

“The key to making money in stocks is not to get scared out of them.” – Peter Lynch

“The market is like a large movie theater with a small door.” – Charlie Munger

“Time is the friend of the wonderful company, the enemy of the mediocre.” – Warren Buffett

“You must learn to be patient in stocks, or you will not be patient in anything else.” – Peter Lynch

“The four most dangerous emotions in investing are fear, greed, hope, and ignorance.” – William O’Neil

“The investor’s job is to select, not to time.” – John Bogle

“The stock market is designed to transfer money from the Active to the Patient.” – Warren Buffett

“Don’t look for the needle in the haystack. Just buy the haystack.” – John Bogle

“To succeed in the market, you must have the courage of your convictions.” – Peter Lynch

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” – Benjamin Graham

“Investing is not nearly as difficult as it looks. Successful investing involves doing a few things right and avoiding serious mistakes.” – John Bogle

“The function of the margin of safety is to render the forecast unnecessary.” – Benjamin Graham

“The most important quality for an investor is temperament, not intellect.” – Warren Buffett

“Investors should remember that excitement and expenses are their enemies.” – Warren Buffett

“Risk comes from not knowing what you’re doing.” – Warren Buffett

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Proverb

“Do not save what is left after spending; instead, spend what is left after saving.” – Warren Buffett

“Rule No.1: Never lose money. Rule No.2: Never forget Rule No.1.” – Warren Buffett

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

“The four most dangerous words in investing are: ‘This time it’s different.'” – Sir John Templeton

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

“Price is what you pay. Value is what you get.” – Warren Buffett

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” – Benjamin Graham

“The best investment you can make is in yourself.” – Warren Buffett

“Risk comes from not knowing what you’re doing.” – Warren Buffett

“Be fearful when others are greedy, and greedy when others are fearful.” – Warren Buffett

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

These quotes offer insights into the philosophy and principles of successful investing as espoused by some of the most renowned investors in history.

Hiring a Property Manager For Your Real Estate Properties

Hiring a property manager to oversee your investment properties and handle tenant-related tasks can be a wise decision, especially if you have multiple properties and prefer to focus on other aspects of your business or personal life. Here’s a detailed guide on how to hire a property manager:

1. Determine Your Needs:

Define Scope: Clearly outline the responsibilities you want the property manager to handle, such as rent collection, maintenance coordination, tenant screening, lease enforcement, and financial reporting.

Number of Properties: Assess the number and types of properties you own to determine the scale of management services required.

2. Research Property Management Companies:

Online Research: Start by researching property management companies in your area. Look for companies with a strong reputation, positive client reviews, and experience managing properties similar to yours.

Referrals: Ask for recommendations from fellow investors, real estate agents, or local landlord associations.

3. Interview Potential Property Managers:

Initial Screening: Contact several property management companies to schedule initial interviews or meetings. Prepare a list of questions to ask, covering topics such as experience, services offered, fees, communication methods, and tenant retention strategies.

Meet in Person: Conduct in-person meetings with potential property managers to assess their professionalism, communication skills, and compatibility with your goals and expectations.

4. Review Contracts and Fees:

Service Agreements: Review the property management contracts carefully, paying close attention to the scope of services, termination clauses, and any additional fees or expenses.

Fee Structure: Understand the property manager’s fee structure, which may include a percentage of monthly rent collected, leasing fees, maintenance markups, and other charges. Compare the fees of different property management companies to ensure they align with your budget and expectations.

5. Check Credentials and References:

Licensing and Certification: Verify that the property management company is licensed and compliant with state and local regulations. Some states require property managers to hold specific licenses or certifications.

References: Request references from current or past clients to gain insight into the property manager’s performance, responsiveness, and overall satisfaction level.

6. Clarify Communication and Reporting:

Communication Channels: Discuss how the property manager will communicate with you and how frequently updates will be provided. Establish clear expectations for communication channels, response times, and emergency procedures.

Reporting: Determine the frequency and format of financial reports you’ll receive, including rent collection summaries, expense reports, and property performance metrics.

7. Finalize the Agreement:

Negotiate Terms: If necessary, negotiate any terms or conditions of the agreement to ensure they align with your needs and preferences.

Sign the Contract: Once you’re satisfied with the terms, sign the property management contract and establish a timeline for transitioning management responsibilities.

8. Transition Management Responsibilities:

Onboarding Process: Work with the property manager to facilitate a smooth transition of management responsibilities, including transferring lease agreements, tenant contact information, keys, and access codes.

Orientation: Provide the property manager with relevant information about your properties, including maintenance history, vendor contacts, and any specific tenant preferences or requirements.

By following these steps and conducting thorough due diligence, you can hire a competent property manager to oversee your investment properties effectively, allowing you to enjoy passive income without the day-to-day hassles of tenant management. Regular communication and periodic reviews will help ensure a successful long-term partnership with your property management company.

House Hacking, Why So Popular?

House hacking, a real estate investment strategy where individuals live in one unit of a multi-unit property while renting out the other units to cover expenses, has gained popularity among investors seeking to generate passive income and build wealth through real estate. Duplexes, in particular, are a popular choice for house hacking due to several compelling reasons:

Income Generation: Duplexes offer the opportunity to generate rental income from one unit while living in the other. By renting out the second unit, house hackers can offset their mortgage payments, property taxes, insurance, and maintenance costs, thereby reducing their housing expenses or even living rent-free.

Lower Down Payment: Financing a duplex as an owner-occupant can offer more favorable terms compared to investment properties. For example, FHA (Federal Housing Administration) loans and other government-backed mortgage programs typically allow owner-occupants to purchase duplexes with lower down payments and more lenient qualification criteria, making it easier for first-time investors to enter the market.

Diversification of Risk: Owning a duplex provides diversification benefits compared to single-family homes. With two rental units, investors have multiple income streams, reducing the risk of vacancy and income loss. Even if one unit is vacant or experiences turnover, the income from the other unit can help cover expenses.

Easier Management: Managing a duplex is often more manageable than larger multi-unit properties, such as apartment buildings or commercial complexes. With only two units to oversee, investors can handle property management tasks more efficiently, reducing the time and effort required to maintain the property and respond to tenant needs.

Flexibility: Duplexes offer flexibility in terms of living arrangements and future use. Investors can choose to live in one unit while renting out the other, allowing them to benefit from rental income while maintaining the option to occupy both units in the future. Additionally, duplexes can be converted into single-family homes or sold separately as individual units, providing exit strategies for investors.

Tax Benefits: Like other investment properties, duplexes offer various tax advantages, including deductions for mortgage interest, property taxes, depreciation, and operating expenses. Investors can also take advantage of favorable capital gains treatment and 1031 exchanges to defer taxes on property appreciation.

Appreciation Potential: Duplexes located in desirable neighborhoods with strong rental demand and appreciation potential can provide long-term wealth accumulation through property appreciation. As property values increase over time, investors can build equity and leverage their duplexes to finance additional real estate investments or other financial goals.

Overall, the combination of rental income, favorable financing options, diversification benefits, management ease, flexibility, tax advantages, and appreciation potential makes duplexes an attractive option for house hacking and real estate investment. However, investors should conduct thorough due diligence, evaluate market conditions, and carefully analyze the financials to ensure that a duplex aligns with their investment objectives and risk tolerance.

Investing in Currency Markets

Investing in currencies, also known as forex (foreign exchange) trading, can be both exciting and challenging. It involves buying and selling currencies with the aim of profiting from changes in exchange rates. Here’s a detailed overview of how currency investing works and how traders can make money from it:

Understanding Exchange Rates:

Exchange rates represent the value of one currency relative to another. They are determined by supply and demand dynamics in the foreign exchange market, which is one of the largest and most liquid financial markets in the world. Exchange rates fluctuate continuously due to various factors, including:

Economic Indicators: Economic data such as GDP growth, inflation rates, employment figures, and trade balances can influence currency values. Strong economic performance typically leads to appreciation of a country’s currency, while weak economic data may cause depreciation.

Interest Rates: Central banks adjust interest rates to control inflation and stimulate economic growth. Higher interest rates generally attract foreign investment, leading to an appreciation of the currency. Conversely, lower interest rates may lead to depreciation as investors seek higher yields elsewhere.

Geopolitical Events: Political instability, conflicts, elections, and trade tensions can affect investor sentiment and currency values. Uncertainty often leads to volatility in exchange rates as traders react to news and developments.

Market Sentiment: Investor confidence and risk appetite influence currency movements. Positive sentiment towards a country’s economy or political stability can drive demand for its currency, while negative sentiment can lead to selling pressure.

Speculation: Traders buy and sell currencies based on their expectations of future exchange rate movements. Speculative trading can amplify short-term fluctuations in exchange rates, creating opportunities for profit.

How Currency Trading Works:

Currency trading takes place in the forex market, where participants, including banks, financial institutions, corporations, governments, and individual traders, buy and sell currencies. The forex market operates 24 hours a day, five days a week, allowing traders to engage in round-the-clock trading.

To trade currencies, investors typically use a broker, which provides access to the forex market and trading platforms. Traders can choose from various trading strategies, including:

Spot Trading: In spot forex trading, currencies are bought and sold for immediate delivery at the current exchange rate. Spot trading is the most common form of currency trading and offers liquidity and flexibility for traders.

Forward Contracts: Forward contracts involve agreements to buy or sell currencies at a specified price for delivery at a future date. Forward contracts are used for hedging against currency risk or speculating on future exchange rate movements.

Futures and Options: Currency futures and options are derivative contracts that allow traders to speculate on or hedge against exchange rate movements. Futures contracts obligate the buyer to purchase or sell a currency at a predetermined price and date, while options provide the right, but not the obligation, to buy or sell currencies at a specified price within a set timeframe.

Making Money in Currency Trading:

Currency traders aim to profit from exchange rate movements by buying currencies they expect to appreciate and selling currencies they expect to depreciate. Here are some common ways traders make money in currency trading:

Capitalizing on Exchange Rate Trends: Traders analyze technical and fundamental factors to identify trends in exchange rates and take positions accordingly. They may use technical analysis tools, such as chart patterns and indicators, to identify entry and exit points.

Carrying Trades: In carry trades, traders borrow currencies with low interest rates and invest in currencies with higher interest rates to profit from the interest rate differential. Carry trades can generate returns from both interest rate differentials and exchange rate movements.

Arbitrage: Arbitrage involves exploiting price differences between currency pairs or markets to profit from inefficiencies. Traders may engage in triangular arbitrage, where they simultaneously buy and sell three currencies to exploit discrepancies in exchange rates.

Hedging: Corporations, investors, and financial institutions use currency hedging strategies to mitigate currency risk and protect against adverse exchange rate movements. Hedging involves taking offsetting positions in the forex market to reduce the impact of currency fluctuations on portfolio returns.

Algorithmic Trading: Algorithmic trading, also known as automated trading or algo trading, involves using computer algorithms to execute trades based on predefined rules and parameters. Algorithmic trading can capitalize on market inefficiencies and execute trades at high speeds.

It’s important to note that currency trading carries risks, including market volatility, leverage, geopolitical events, and economic factors. Traders should conduct thorough research, manage risk effectively, and use proper risk management techniques to protect their capital and maximize returns in the forex market. Additionally, traders should stay informed about global economic developments, central bank policies, and geopolitical events that can impact currency values and exchange rates.

Commodities, A Good Investment?

Investing in commodities involves buying and selling physical goods or financial instruments that are based on the prices of raw materials or primary agricultural products. Commodities can be an attractive investment option for diversification and hedging against inflation, but they also come with unique risks and considerations. Here’s an in-depth explanation of how to invest in commodities, strategies to increase returns, and some examples of popular commodities:

How to Invest in Commodities:

Direct Ownership: One way to invest in commodities is through direct ownership, where investors physically buy and hold the underlying assets. For example, you can purchase gold bars or silver coins as a direct investment in precious metals.

Futures Contracts: Futures contracts are agreements to buy or sell a specific quantity of a commodity at a predetermined price on a future date. Futures contracts are traded on commodities exchanges and provide investors with exposure to commodity prices without the need for physical ownership.

Exchange-Traded Funds (ETFs): Commodity ETFs are investment funds that track the performance of a specific commodity or a basket of commodities. These ETFs can be bought and sold like stocks on major stock exchanges, providing investors with convenient access to commodity markets.

Commodity Mutual Funds: Similar to ETFs, commodity mutual funds invest in a diversified portfolio of commodities. These funds are managed by professional fund managers and offer exposure to commodity prices through various investment strategies.

Commodity-Linked Notes: Commodity-linked notes are debt securities whose returns are tied to the performance of a specific commodity or a basket of commodities. Investors receive principal protection at maturity, along with potential returns linked to commodity price movements.

Strategies to Increase Returns:

Diversification: Investing in a diversified portfolio of commodities can help spread risk and reduce the impact of price fluctuations in any single commodity. Diversification can be achieved by investing in commodity ETFs, mutual funds, or diversified commodity indices.

Market Timing: Monitoring supply and demand dynamics, geopolitical events, and macroeconomic indicators can help investors identify opportune times to buy or sell commodities. By anticipating shifts in commodity prices, investors can potentially enhance returns through strategic buying or selling.

Leverage: Futures contracts allow investors to trade commodities with leverage, meaning they can control a larger position with a smaller amount of capital. While leverage can amplify returns, it also increases risk, as losses can exceed the initial investment.

Seasonal Trends: Certain commodities exhibit seasonal price patterns due to factors such as weather conditions, harvest cycles, or consumer demand. Understanding these seasonal trends can help investors capitalize on recurring price movements and increase returns.

Popular Commodities:

Precious Metals: Gold, silver, platinum, and palladium are popular precious metals that are commonly used as stores of value and hedges against inflation and currency fluctuations.

Energy: Crude oil, natural gas, and gasoline are essential energy commodities that are widely traded on global markets. Energy prices are influenced by factors such as geopolitical events, supply disruptions, and changes in global demand.

Agricultural Products: Commodities such as wheat, corn, soybeans, coffee, and sugar are agricultural products that are traded on commodities exchanges. Agricultural commodity prices are influenced by factors such as weather conditions, crop yields, and global demand trends.

Industrial Metals: Copper, aluminum, zinc, and nickel are industrial metals that are used in various manufacturing and construction industries. Industrial metal prices are influenced by factors such as economic growth, infrastructure development, and global trade dynamics.

Investing in commodities can provide diversification benefits and potential returns, but it’s essential to carefully evaluate the risks and conduct thorough research before investing. Factors such as commodity-specific supply and demand dynamics, geopolitical events, and macroeconomic trends can significantly impact commodity prices, so staying informed and implementing disciplined investment strategies is crucial for success in commodity investing. Additionally, consulting with a financial advisor can provide personalized guidance based on your investment objectives and risk tolerance.

EFTs, A Good Investment?

Investing in ETFs (Exchange-Traded Funds) involves several steps, from understanding what ETFs are to selecting the right funds for your investment goals. Here’s an in-depth guide:

1. Understanding ETFs:

What are ETFs?: ETFs are investment funds that are traded on stock exchanges, much like individual stocks. They typically hold a diversified portfolio of assets, such as stocks, bonds, commodities, or a combination thereof.

Benefits of ETFs:

Diversification: ETFs provide exposure to a basket of assets, reducing individual stock or sector risk.

Liquidity: ETFs can be bought and sold throughout the trading day, unlike mutual funds, which are traded once per day.

Cost-Effectiveness: ETFs often have lower expense ratios compared to mutual funds, making them a cost-effective investment option.

Transparency: ETFs disclose their holdings on a regular basis, allowing investors to see what they own.

2. Choosing an ETF:

Asset Class: Determine which asset class you want exposure to—equities (stocks), fixed income (bonds), commodities, or a specific sector.

Index vs. Actively Managed: Decide whether you prefer index ETFs, which track a specific index, or actively managed ETFs, where fund managers actively select securities.

Expense Ratio: Consider the expense ratio, which represents the annual fee charged by the ETF provider. Lower expense ratios translate to lower costs for investors.

Liquidity: Check the trading volume and bid-ask spread of the ETF to ensure sufficient liquidity for trading.

3. Opening an Investment Account:

Brokerage Account: You’ll need a brokerage account to buy and sell ETFs. Choose a reputable online brokerage that offers a wide selection of ETFs and competitive trading fees.

Account Setup: Follow the brokerage’s instructions to open and fund your investment account. This typically involves providing personal information, verifying your identity, and transferring funds into the account.

4. Placing Trades:

Research: Conduct thorough research on the ETFs you’re interested in, considering factors such as performance history, underlying holdings, and investment strategy.

Order Type: Decide whether you want to place a market order (executed at the current market price) or a limit order (executed at a specified price or better).

Transaction: Log in to your brokerage account, enter the ticker symbol of the ETF you want to buy, specify the quantity, and select the order type. Review and submit your trade.

5. Monitoring and Rebalancing:

Portfolio Monitoring: Regularly monitor the performance of your ETF investments, keeping an eye on factors such as market trends, economic indicators, and changes in the ETF’s underlying holdings.

Rebalancing: Rebalance your portfolio periodically to maintain your desired asset allocation. This may involve buying or selling ETFs to bring your portfolio back in line with your investment objectives.

Tax Considerations: Be mindful of tax implications when buying and selling ETFs, such as capital gains taxes on realized profits and potential tax-efficient strategies like tax-loss harvesting.