Investing in ETFs (Exchange-Traded Funds) involves several steps, from understanding what ETFs are to selecting the right funds for your investment goals. Here’s an in-depth guide:

1. Understanding ETFs:

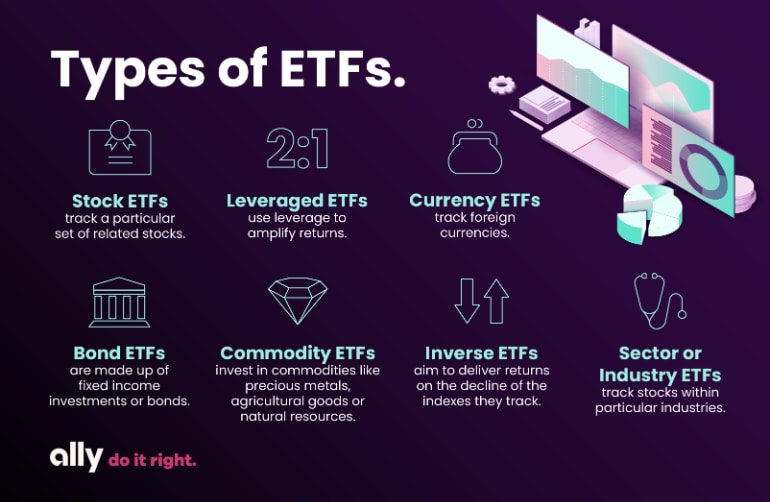

What are ETFs?: ETFs are investment funds that are traded on stock exchanges, much like individual stocks. They typically hold a diversified portfolio of assets, such as stocks, bonds, commodities, or a combination thereof.

Benefits of ETFs:

Diversification: ETFs provide exposure to a basket of assets, reducing individual stock or sector risk.

Liquidity: ETFs can be bought and sold throughout the trading day, unlike mutual funds, which are traded once per day.

Cost-Effectiveness: ETFs often have lower expense ratios compared to mutual funds, making them a cost-effective investment option.

Transparency: ETFs disclose their holdings on a regular basis, allowing investors to see what they own.

2. Choosing an ETF:

Asset Class: Determine which asset class you want exposure to—equities (stocks), fixed income (bonds), commodities, or a specific sector.

Index vs. Actively Managed: Decide whether you prefer index ETFs, which track a specific index, or actively managed ETFs, where fund managers actively select securities.

Expense Ratio: Consider the expense ratio, which represents the annual fee charged by the ETF provider. Lower expense ratios translate to lower costs for investors.

Liquidity: Check the trading volume and bid-ask spread of the ETF to ensure sufficient liquidity for trading.

3. Opening an Investment Account:

Brokerage Account: You’ll need a brokerage account to buy and sell ETFs. Choose a reputable online brokerage that offers a wide selection of ETFs and competitive trading fees.

Account Setup: Follow the brokerage’s instructions to open and fund your investment account. This typically involves providing personal information, verifying your identity, and transferring funds into the account.

4. Placing Trades:

Research: Conduct thorough research on the ETFs you’re interested in, considering factors such as performance history, underlying holdings, and investment strategy.

Order Type: Decide whether you want to place a market order (executed at the current market price) or a limit order (executed at a specified price or better).

Transaction: Log in to your brokerage account, enter the ticker symbol of the ETF you want to buy, specify the quantity, and select the order type. Review and submit your trade.

5. Monitoring and Rebalancing:

Portfolio Monitoring: Regularly monitor the performance of your ETF investments, keeping an eye on factors such as market trends, economic indicators, and changes in the ETF’s underlying holdings.

Rebalancing: Rebalance your portfolio periodically to maintain your desired asset allocation. This may involve buying or selling ETFs to bring your portfolio back in line with your investment objectives.

Tax Considerations: Be mindful of tax implications when buying and selling ETFs, such as capital gains taxes on realized profits and potential tax-efficient strategies like tax-loss harvesting.

By understanding the fundamentals of ETF investing and following a systematic approach, you can build a diversified portfolio tailored to your financial goals and risk tolerance.