Venture Capital

VC Core Values

Factors for Success

-

Entrepreneurship: VCs typically value entrepreneurship and innovation. They are drawn to founders and teams with bold ideas, strong vision, and the drive to disrupt industries or create new markets.

-

Risk-taking: Venture capitalists understand that investing in startups inherently involves taking risks. They are willing to take calculated risks on early-stage companies with the potential for high returns, even though many of these investments may fail.

Vision & Creation

-

Long-term Vision: VCs often have a long-term perspective, understanding that it may take several years for a startup to achieve significant growth and profitability. They are patient investors who are willing to support their portfolio companies through multiple rounds of funding and stages of development.

-

Value Creation: Venture capitalists aim to create value not only for themselves and their investors but also for the founders, employees, customers, and society as a whole. They seek to invest in companies that have the potential to make a positive impact and solve significant problems.

Integrity & Transparency

-

Transparency and Integrity: Trust and integrity are essential in the venture capital industry. VCs strive to maintain open and honest communication with their portfolio companies and stakeholders, acting with integrity in all their dealings.

Diversity and Inclusion

- Diversity and Inclusion: Many venture capitalists recognize the importance of diversity and inclusion in entrepreneurship and strive to support founders from diverse backgrounds. They understand that diverse perspectives can lead to better decision-making and innovation.

Venture Capitalism at its Finest

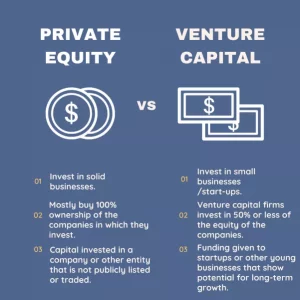

A venture capitalist (VC) is an individual or firm that provides financial capital to startups and small businesses with high growth potential in exchange for equity ownership. Essentially, venture capitalists are investors who seek to profit from the rapid growth and success of early-stage companies.

Here’s a breakdown of what they typically do:

-

Identify Promising Opportunities: VCs actively search for promising business opportunities and startups with innovative ideas, strong growth potential, and capable management teams.

-

Investment: Once they identify a promising opportunity, VCs invest their own funds or funds from investors (limited partners) into the startup in exchange for an ownership stake in the company.

-

Provide Expertise and Guidance: Beyond just providing capital, venture capitalists often provide valuable expertise, mentorship, and guidance to the startup founders. This can include strategic advice, industry connections, and help with recruiting key personnel.

-

Monitor and Support: VCs closely monitor the progress of their portfolio companies, offering support and resources as needed to help them grow and succeed. This may involve participating in board meetings, offering operational advice, and connecting the startup with potential customers or partners.

-

Exit Strategy: Venture capitalists typically aim to realize a return on their investment within a certain time frame, usually around 5 to 10 years. They may achieve this through various exit strategies, such as selling their stake in the company through an initial public offering (IPO), a merger or acquisition, or a secondary sale of their shares to other investors.

Overall, venture capitalists play a crucial role in fueling innovation and economic growth by providing the capital and expertise needed to help promising startups grow into successful businesses. However, they also take on significant risks, as many startups fail, and their investments may not yield the desired returns.

Average VC Contributes

High-end VC Contributes

Top of the line VC Contributes

The VC Portal is your exclusive gateway to a world of opportunities within the venture capital ecosystem. Designed for founders, investors, and industry professionals, this platform provides seamless access to essential tools, resources, and connections that drive success.

What Awaits You in the VC Portal?

-

Curated Investment Opportunities:

Explore a portfolio of high-potential startups and businesses seeking funding, carefully vetted to match your investment goals.

-

Founder Resources:

Access templates, pitch decks, guides, and mentorship opportunities to refine your strategy and accelerate growth.

-

Exclusive Networking:

Connect with a global community of venture capitalists, entrepreneurs, and industry leaders through virtual events, forums, and private discussions.

-

Analytics & Insights:

Stay ahead with real-time market data, trends, and reports tailored for VC decision-making.

-

Deal Flow Management:

Track and manage potential investments with integrated tools, keeping everything organized and actionable.

How to Enter the Deal Maker Portal

-

Log In:

-

Use your unique credentials to access the platform securely.

-

Personalize Your Profile:

-

Set up your profile to showcase your expertise and interests, making it easier to connect with like-minded professional

-

Start Exploring:

-

Dive into curated opportunities, join discussions, and leverage tools designed to empower your journey in venture capital.