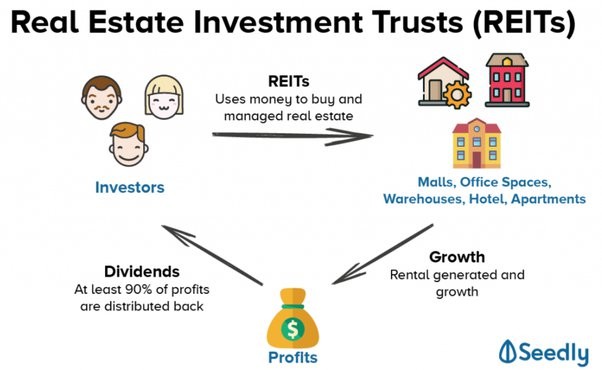

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate across various sectors, including residential, commercial, industrial, retail, and healthcare properties. REITs provide investors with a way to invest in real estate assets without directly owning physical properties. Here’s a detailed exploration of REITs and how investors can profit from them:

Structure and Classification:

Legal Structure: REITs are structured as corporations, trusts, or associations that own and manage a portfolio of real estate assets. They are required to comply with specific regulatory requirements and tax rules to qualify as REITs.

Classification: REITs are classified into two main categories based on how they generate income:

Equity REITs: Equity REITs own and operate income-producing properties, such as office buildings, apartments, shopping centers, and industrial warehouses. They generate rental income from tenants and may also benefit from capital appreciation of their properties.

Mortgage REITs (mREITs): Mortgage REITs invest in mortgage-backed securities, mortgage loans, or other debt instruments secured by real estate. They earn income from interest payments on mortgages and may use leverage to enhance returns.

Income Generation:

Rental Income: Equity REITs generate rental income from leasing properties to tenants under long-term lease agreements. Rental income is a primary source of revenue for equity REITs, providing a steady stream of cash flow to investors.

Interest Income: Mortgage REITs earn income from interest payments on mortgage loans or mortgage-backed securities. They typically invest in a diversified portfolio of mortgage assets with varying maturities and credit quality to generate interest income.

Dividend Distributions: REITs are required by law to distribute a significant portion of their taxable income to shareholders in the form of dividends. Most REITs distribute at least 90% of their taxable income to shareholders to maintain their tax-advantaged status. Dividend distributions are a key attraction for income-oriented investors seeking regular income from their investments.

Portfolio Diversification:

Diversification Benefits: REITs offer investors exposure to a diversified portfolio of real estate assets across different sectors, geographic locations, and property types. This diversification helps reduce risk by spreading exposure to individual properties or markets and can enhance portfolio stability and resilience.

Access to Professional Management: REITs are managed by experienced real estate professionals who oversee property acquisition, leasing, operations, and financing activities. Investors benefit from professional management expertise and economies of scale in property management, which can lead to enhanced returns and reduced operational risks.

Liquidity and Accessibility:

Publicly Traded Securities: Many REITs are publicly traded on stock exchanges, providing investors with liquidity and ease of access to real estate investments. Investors can buy and sell REIT shares like other publicly traded securities through brokerage accounts, making REITs accessible to a wide range of investors.

Low Minimum Investment: REITs allow investors to gain exposure to real estate assets with relatively low minimum investment requirements compared to direct ownership of properties. This makes REITs accessible to individual investors who may not have the capital or expertise to invest in physical real estate.

Tax Benefits:

Pass-through Taxation: REITs are pass-through entities that are not subject to corporate income tax at the entity level. Instead, they pass on taxable income to shareholders, who are responsible for paying taxes on dividends received. This tax-efficient structure allows REITs to distribute a significant portion of their income to shareholders.

Tax-Advantaged Dividends: Dividends received from REITs may qualify for favorable tax treatment, such as qualified dividend tax rates, depending on the investor’s tax bracket and holding period. Additionally, some REIT dividends may be classified as return of capital, reducing immediate tax liabilities for investors.

Potential for Capital Appreciation:

Market Dynamics: REITs can benefit from capital appreciation as property values increase over time due to factors such as rental income growth, property appreciation, and favorable market conditions.

Investment Performance: Historically, REITs have delivered competitive long-term total returns, including both dividends and capital appreciation, compared to other asset classes such as stocks and bonds. However, past performance is not indicative of future results, and investment returns can vary based on market conditions and economic factors.

In summary, REITs offer investors a way to invest in real estate assets through publicly traded securities, providing diversification, income generation, liquidity, accessibility, tax benefits, and potential for capital appreciation. By investing in REITs, investors can gain exposure to a diversified portfolio of income-producing properties and participate in the long-term growth potential of the real estate market.