Here are some key characteristics of hedge funds:

-

Managerial Expertise: Hedge funds are typically managed by experienced investment professionals who employ active management strategies to seek out market inefficiencies, exploit opportunities, and generate alpha (excess returns) for investors.

-

Diverse Investment Strategies: Hedge funds can utilize a wide range of investment strategies, including long/short equity, global macro, event-driven, quantitative/statistical arbitrage, distressed debt, merger arbitrage, and relative value strategies, among others. This diversity allows hedge funds to adapt to changing market conditions and capitalize on a broad array of investment opportunities.

-

Performance-Based Compensation: Hedge fund managers often receive performance-based compensation, typically in the form of a management fee (usually around 1-2% of assets under management) and a performance fee (typically 20% of profits above a certain threshold, known as the “high-water mark”). This fee structure aligns the interests of the fund manager with those of the investors, as managers are incentivized to generate positive returns and outperform the market.

-

Limited Regulation: Hedge funds are subject to less regulatory oversight compared to mutual funds, allowing them greater flexibility in their investment strategies and operations. However, this lack of regulation also means that hedge funds may engage in riskier or less transparent practices, and investors should conduct thorough due diligence before investing.

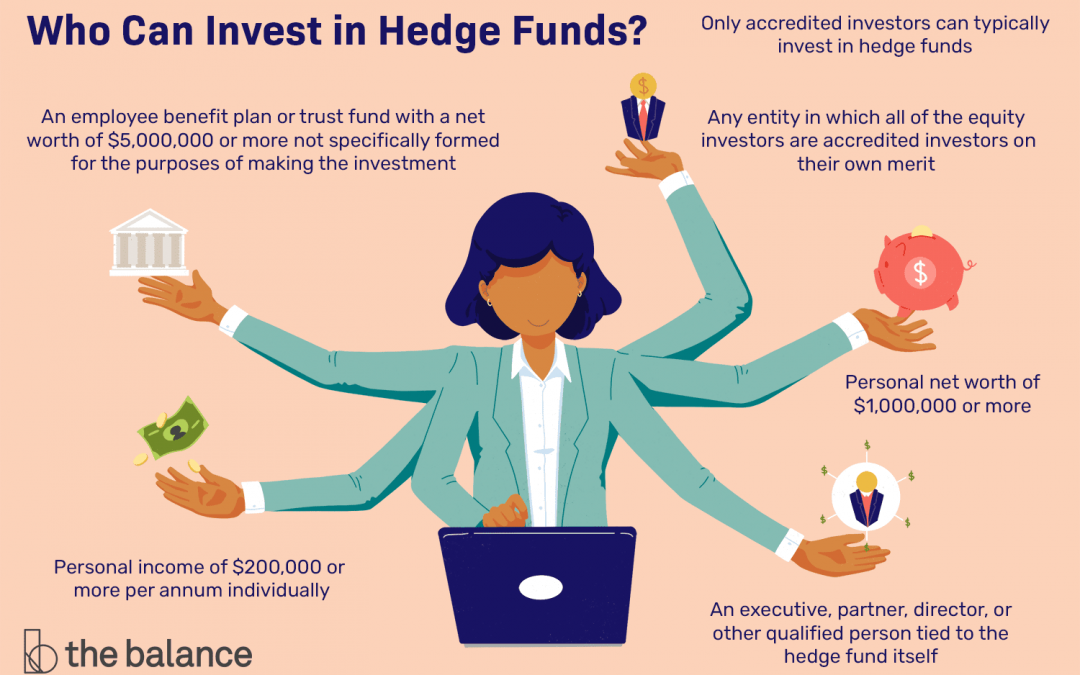

Investing in a hedge fund typically requires meeting certain eligibility criteria, such as being an accredited investor or qualified purchaser, as defined by securities regulations in the investor’s jurisdiction. These criteria generally involve meeting minimum income or net worth thresholds, as well as demonstrating a level of financial sophistication and understanding of the risks associated with hedge fund investing.

Once eligible, investors can invest in a hedge fund by:

-

Identifying Suitable Funds: Investors can research and evaluate different hedge funds based on their investment objectives, strategies, historical performance, risk profiles, fees, and other relevant factors. This process may involve consulting with financial advisors, conducting due diligence on fund managers, and reviewing fund offering documents, such as private placement memoranda (PPMs) or prospectuses.

-

Completing Subscription Documents: Investors interested in investing in a hedge fund typically need to complete subscription documents provided by the fund manager or sponsor. These documents may include a subscription agreement, investor questionnaire, and other legal and regulatory disclosures.

-

Meeting Minimum Investment Requirements: Hedge funds often have minimum investment requirements, which can vary widely depending on the fund’s strategy, size, and investor base. Minimum investments can range from tens of thousands to millions of dollars or more, and investors should ensure they meet the fund’s minimum requirements before committing capital.

-

Executing Investment Terms: Once the subscription documents are completed and submitted, investors typically wire funds to the hedge fund’s designated bank account or custodian, in accordance with the terms outlined in the offering documents. Upon receipt of funds, investors become limited partners or shareholders in the hedge fund and are entitled to participate in the fund’s investment activities and share in any profits or losses generated by the fund.

It’s important for investors to conduct thorough due diligence and carefully consider the risks and potential rewards associated with hedge fund investing before making any commitments. While hedge funds can offer opportunities for diversification, alpha generation, and downside protection, they also involve risks such as illiquidity, leverage, manager risk, and market volatility. Consulting with financial advisors, conducting independent research, and seeking professional guidance can help investors make informed decisions and navigate the complexities of hedge fund investing.