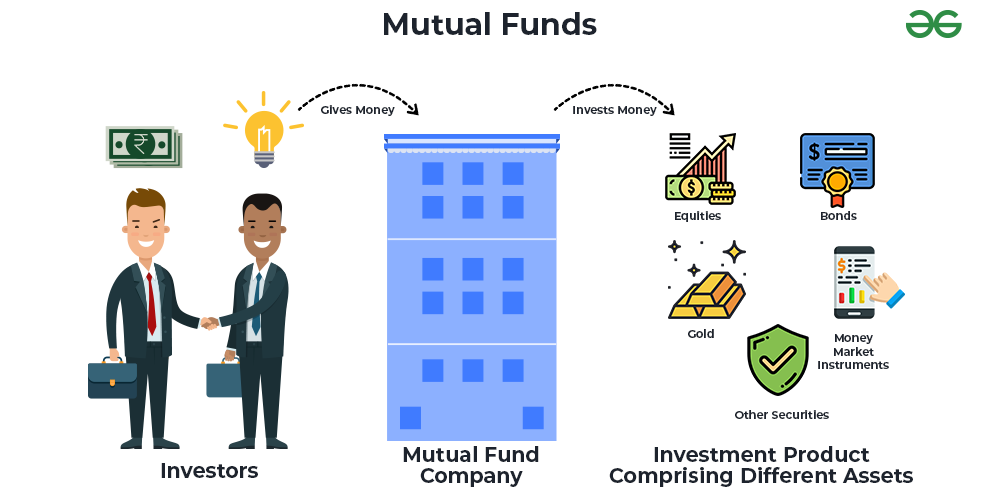

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Here’s a detailed explanation of how you can potentially get a good return on mutual funds:

Diversification: One of the key benefits of mutual funds is diversification. By investing in a mutual fund, you gain exposure to a broad range of securities across various sectors and industries. This diversification helps spread risk because if one investment underperforms, gains from other investments can offset the losses.

Professional Management: Mutual funds are managed by professional fund managers who analyze market trends, economic conditions, and individual securities to make investment decisions. These managers have expertise and resources to actively manage the fund’s portfolio with the aim of achieving superior returns for investors.

Economies of Scale: Because mutual funds pool money from numerous investors, they can achieve economies of scale. This means that they can negotiate lower transaction costs and access to certain investments that may not be available to individual investors. Lower costs can enhance returns for investors over the long term.

Access to Different Asset Classes: Mutual funds offer access to a wide range of asset classes including stocks, bonds, real estate, and commodities. Depending on your investment goals and risk tolerance, you can choose mutual funds that invest in specific asset classes or a combination of them to diversify your portfolio and potentially enhance returns.

Reinvestment of Dividends and Capital Gains: Many mutual funds automatically reinvest dividends and capital gains distributions back into the fund. This process, known as compounding, allows investors to benefit from the power of reinvesting earnings over time, which can significantly boost returns, especially in the long term.

Cost Efficiency: Mutual funds charge fees and expenses for managing the fund, known as the expense ratio. While fees can vary among mutual funds, many funds offer competitive expense ratios, particularly index funds and exchange-traded funds (ETFs). Choosing funds with lower expense ratios can help maximize returns by reducing the impact of fees on your investment performance.

Long-Term Investing: Mutual funds are well-suited for long-term investing because they provide exposure to a diversified portfolio of securities. Over the long term, financial markets tend to grow, and investing in mutual funds allows you to participate in this growth potential. Additionally, long-term investing reduces the impact of short-term market fluctuations and volatility on your investment returns.

Regular Monitoring and Review: While mutual funds are professionally managed, it’s essential to regularly monitor and review your investments to ensure they align with your financial goals and risk tolerance. Periodically evaluating the performance of your mutual funds and making adjustments as needed can help optimize returns and keep your investment strategy on track.

Overall, getting a good return on mutual funds involves selecting funds that align with your investment objectives, diversifying your portfolio, minimizing costs, and maintaining a long-term perspective on investing. It’s also crucial to conduct thorough research and seek professional advice if needed to make informed investment decisions.